7 Tips for Choosing a Financial Content Marketing Agency

Choosing a financial content marketing agency is a decision that requires careful attention to detail. Financial services demand more than just creative storytelling—they call for precise strategies, regulatory awareness, and a focus on measurable outcomes. The right agency must not only craft engaging content but also understand the complexities of compliance and conversion-driven tactics to truly resonate with your audience.

This article guides you through seven practical tips to help you assess potential partners with confidence. From evaluating conversion metrics and reviewing detailed case studies to scrutinizing content workflows and confirming industry-specific expertise, these insights are designed to equip you with the necessary tools to make an informed choice. Read on to discover how to align your marketing needs with an agency that delivers both strategic value and tangible results.

1. Assess Conversion-Driven Strategies

In the financial industry, attracting visitors is only part of the puzzle. The real win comes from converting those visitors into qualified leads or customers. A conversion-focused strategy ensures that every piece of content is designed not just to attract eyes, but also to prompt measurable actions that contribute to your bottom line.

Why Conversion Focus Matters

Emphasizing conversions means that your marketing efforts are directly tied to revenue-generating activities. For financial institutions, key conversion metrics—such as lead generation rates, account sign-ups, or the engagement with a specific call-to-action—offer a clear view of an agency’s effectiveness. A robust conversion strategy indicates that an agency is not only aware of traffic figures but is also skilled at nurturing prospects through well-designed funnels. According to Concurate’s guide on choosing a content marketing agency, viewing conversion as the primary success metric is essential, as it reflects the actual impact of content on business goals.

Leveraging Data to Measure Conversions

Data analytics is the backbone of any conversion-driven strategy. A competent financial content marketing agency will use advanced tools and methodologies to track each stage of the buyer journey. Essential metrics to monitor include the number of new leads, conversion rates from targeted actions, and overall customer acquisition costs. By harnessing such insights, an agency can continually optimize campaigns, ensuring that every dollar spent is aimed at improving conversion outcomes. In practice, this means frequently reviewing key performance indicators and adjusting strategies based on measurable data, ultimately leading to smarter investments and higher ROI.

By focusing on conversion-driven strategies, you ensure the agency’s efforts translate directly into outcomes that matter—fueling sustainable growth and delivering the type of results that can be tracked and celebrated.

2. Examine Agency Case Studies and Track Record

Before partnering with a financial content marketing agency, it's crucial to review their history of success. Looking at actual examples of their work provides valuable insights into their strategic approach and their ability to deliver results. A detailed examination of case studies helps you understand how an agency has tackled challenges similar to yours and whether their methods align with your business objectives.

Evaluating Past Success Through Case Studies

Analyzing real-world projects gives you an opportunity to assess the agency’s capabilities in context. Look for case studies that clearly outline the challenges, strategies implemented, and measurable outcomes achieved. Insights from Inc’s article on vetting content marketing agencies suggest that agencies with well-documented examples of success are more likely to replicate those results for your business. Examining these case studies can reveal whether the agency has a strong process for driving engagement, managing complex regulatory requirements, and ultimately converting prospects into clients.

Interpreting Performance Metrics

Beyond storytelling, concrete data is essential. Focus on key performance indicators such as lead generation, conversion rates, and overall campaign ROI. These metrics provide transparency and help you evaluate if the agency’s past performance is in line with your expected outcomes. Effective reporting should break down the numbers behind each case study, offering a clear picture of how strategies translate into measurable success. This quantitative assessment, combined with qualitative insights, ensures that you are partnering with an agency that not only excels in creative execution but also in delivering results that impact your bottom line.

3. Look for a Solid Content Creation & Distribution Process

A strong content creation and distribution process is the backbone of a successful financial content marketing agency. Beyond having a sound strategy, it’s vital to ensure that the agency’s workflow—from brainstorming ideas to publishing tailored content—is both organized and designed to drive performance. A well-structured process minimizes bottlenecks and helps maintain quality while scaling efforts to reach diverse audience segments.

Understanding the Content Workflow

A reputable agency will outline a clear, step-by-step process for content production. This typically starts with in-depth market research and ideation, ensuring that every topic is backed by data and aligned with your brand’s objectives. From there, the process should cover planning, drafting, and internal reviews, transitioning smoothly into editing and final publication. A defined workflow not only enhances efficiency but also guarantees that content meets both creative and compliance standards—a crucial factor in the highly regulated financial sector. Insights from industry experts, like those shared by WebFX’s guide on choosing content marketing companies, demonstrate that agencies with a systematic and transparent process are better equipped to produce content that resonates with audiences while delivering measurable results.

Content Repurposing and Scalability

Another hallmark of a solid content creation process is its ability to repurpose high-quality content across various channels. An agency that can adapt a single piece—such as a detailed blog post—into targeted social media updates, engaging infographics, or even video scripts maximizes the return on your investment. This strategic repurposing not only extends the lifespan of the content but also ensures consistent messaging across platforms. Furthermore, scalability is essential for growing brands; a robust process allows the agency to effortlessly increase volume and introduce new formats as trends evolve. By leveraging multiple touchpoints, the agency can ensure your content remains both relevant and visible, consistently supporting your overall marketing objectives.

4. Prioritize Industry-Specific Expertise in Financial Services

In today's competitive financial landscape, partnering with an agency that understands your industry is more than just a plus—it’s essential. Financial institutions face unique challenges ranging from complex regulatory requirements to the need for precision in every piece of content. An agency experienced in the financial sector can navigate these intricacies with ease, ensuring that your marketing efforts are compliant, authoritative, and tailored to resonate with your target audience.

The Value of Financial Sector Experience

Expertise in financial services goes far beyond general content creation. Agencies that have specialized knowledge are well-versed in the regulatory nuances, industry-specific jargon, and the strategic demands of financial products and services. This specialized insight ensures that every piece of content not only meets compliance standards but also speaks directly to the concerns and needs of your audience. For instance, when developing campaigns, such an agency will take into account the importance of establishing trust and credibility—a cornerstone in finance where transparency and security are paramount.

Reviewing Relevant Portfolio and Expertise

When evaluating a financial content marketing agency, closely examine their portfolio for evidence of success within the financial industry. Look for case studies and projects that mirror your challenges and objectives. This might include campaigns for banks, credit unions, or fintech companies where the agency has demonstrated a clear understanding of regulatory constraints and audience behavior. Check if the projects reveal a clear narrative on how the agency addressed industry-specific challenges and delivered measurable results. An agency’s previous work should illustrate tailored strategies, from nuanced messaging that aligns with financial regulations to innovative approaches in engaging sophisticated audiences. This kind of detailed portfolio review will help ensure you partner with a team that is as familiar with your sector as you are.

5. Verify Compliance with Regulatory and Ethical Standards

In the financial sector, compliance isn’t just a box to check—it’s an essential element that builds trust and protects your brand. When selecting a financial content marketing agency, it’s imperative to verify that they follow all regulatory requirements and uphold ethical standards. This diligence helps ensure your campaigns adhere to the strict guidelines that protect both your institution and your audience.

Adhering to FTC Guidelines for Transparency

Financial marketing content must be transparent, especially when it comes to endorsements and disclosures. A reputable agency will ensure that all content adheres to the FTC’s Endorsement Guides. This means your campaigns will clearly indicate any sponsored content, paid partnerships, or affiliate relationships, leaving no room for ambiguity. Implementing these standards not only complies with legal requirements but also boosts consumer confidence by demonstrating openness in all marketing communications.

When evaluating potential agencies, ask for detailed examples of how they implement these guidelines in past projects. Look for case studies that illustrate clear, compliant disclosures and transparent communication practices. Doing so will help you confirm that the agency prioritizes both the letter and the spirit of regulatory standards, ultimately safeguarding your brand and building more honest connections with your audience.

Ensuring Ethical Marketing Practices

Alongside regulatory compliance, ethical marketing practices play a crucial role in maintaining your organization’s integrity. A strong ethical framework means that the agency avoids deceptive tactics and focuses on delivering factual, unbiased content. Ethical marketing not only preserves your reputation but also enhances customer trust—a cornerstone in the financial industry.

To assess ethical standards, inquire about the agency’s process for content review and quality control. Ensure they have formal procedures in place to avoid misleading claims or aggressive sales tactics. By verifying that an agency is committed to ethical marketing, you can be confident that your content will be presented responsibly, aligning with both industry best practices and your organizational values.

Together, adherence to regulatory guidelines and commitment to ethical marketing practices form the foundation of a sustainable, trustworthy partnership—a must-have for any financial institution looking to thrive in a competitive market.

6. Analyze Content Repurposing and Multi-Channel Strategies

Financial institutions must extract maximum value from every content asset, and a smart financial content marketing agency understands how to do just that. Repurposing content into various formats and distributing it across multiple channels not only extends its lifespan but also amplifies its reach. By analyzing these strategies, you can assess whether an agency is positioned to generate the best possible return on your investment.

Maximizing ROI Through Content Repurposing

A dynamic repurposing strategy transforms a single asset into multiple pieces of content, driving efficiency and expanding your content’s impact. For instance, a detailed white paper can be distilled into a series of blog posts, infographics, social media snippets, or even video content. This approach not only saves time and resources but also ensures that your key messages are consistently reinforced across various touchpoints. When evaluating a financial content marketing agency, look for detailed case studies or documented workflows that demonstrate how they have successfully repurposed content in the past. Such examples will indicate that the agency is adept at creating a unified message that resonates with diverse audiences, ultimately leading to higher engagement and improved conversion rates.

Leveraging Multi-Channel Distribution

Effective distribution extends beyond repurposing—it calls for a strategic plan to deliver content across a variety of platforms. A robust multi-channel strategy includes not only the agency’s own blog or website, but also social media networks, email newsletters, video platforms, and even podcasts. This diversified approach ensures that content reaches your audience wherever they are most active. When you assess potential agencies, inquire about their tools and methods for managing multi-channel distribution. Ask how they tailor content for each platform while maintaining a consistent voice and brand identity, and what metrics they use to gauge success. An agency equipped with a sound multi-channel strategy will demonstrate how each platform contributes to increased visibility, stronger audience engagement, and better lead generation—all critical outcomes for a financial content marketing agency.

By focusing on both content repurposing and multi-channel distribution strategies, you can ensure that the agency not only creates valuable content but also maximizes its reach and impact in a cost-effective manner.

7. Evaluate Communication and Project Management Capabilities

When choosing a financial content marketing agency, smooth collaboration is just as important as strategic expertise. Effective communication and rigorous project management can make the difference between a well-executed campaign and missed deadlines or unclear deliverables. In this section, we explore why these qualities are critical and how to assess them during your evaluation process.

The Importance of Clear Communication

Clear communication is the cornerstone of any successful partnership. Regular, open dialogue ensures that expectations are aligned and that any challenges are addressed promptly. Look for an agency that provides dedicated account managers or project leads who are responsive and transparent. According to insights from LeadFuze, establishing a communication cadence—such as weekly updates or roadmap reviews—can help ensure that your project remains on track. Don’t hesitate to ask for examples of how they’ve maintained clear communication in past projects, as this transparency is essential for fostering trust and ensuring that your financial brand’s needs are fully understood.

Effective Project Management and Workflow

A structured project management process not only keeps campaigns on schedule but also ensures that each phase, from ideation to publication, is executed with precision. Ask potential partners to explain their workflow and the tools they use—be it project management software, collaborative dashboards, or scheduling platforms. Drawing on the guidelines from Column Five Media, an effective project management system should include clear milestones, deliverable reviews, and regular performance check-ins. Such systems allow for better resource allocation and timely adjustments, which are critical when dealing with the complexities of financial content that often require adherence to regulatory standards.

Assessing Agency Reputation and Client Feedback

Lastly, client feedback and third-party reviews provide valuable insights into an agency’s reliability and effectiveness. Look for testimonials and case studies that specifically address the agency’s communication practices and project execution. Reviews on platforms like Search Engine Land can help verify whether the agency consistently delivers quality work and manages challenges efficiently. By examining the feedback from previous clients, you can gauge how the agency handles unforeseen issues and adapts to changes—a vital consideration in the dynamic world of financial content marketing.

By evaluating an agency’s communication and project management capabilities, you position yourself to partner with a team that not only understands your industry but is also committed to maintaining transparency and efficiency throughout your collaboration.

8. Understanding the Importance of Financial Content Marketing

Gaining traction in the financial sector requires more than just creative flair—it demands specialized strategies embedded in the nuances of the industry. Financial content marketing is distinct because it needs to convey trust, authority, and reliability while staying aligned with stringent regulatory standards. In a market where credibility is everything, crafting content that is both informative and compliant can set your institution apart. This section unpacks why a tailored approach to content marketing is critical for financial brands and highlights the trends shaping the current landscape.

Why Specialized Marketing is Crucial in Finance

Financial institutions operate in a highly regulated environment where every claim and piece of insight must be both accurate and transparent. A specialized marketing approach goes beyond basic storytelling; it addresses the specific challenges of the financial sector, such as navigating compliance requirements and explaining complex financial products in an accessible manner. This targeted strategy not only builds trust but also establishes the organization as an industry leader, capable of addressing the nuanced concerns of its audience. When content is precisely tailored, it bridges the gap between technical expertise and everyday clarity, ensuring that your audience feels both informed and secure.

Furthermore, trusted financial content helps position your brand as a thought leader in a competitive space. High-quality, specialized content demonstrates an in-depth understanding of both market trends and regulatory demands. This strategic positioning can lead to enhanced visibility, improved customer loyalty, and ultimately, a stronger bottom line. In essence, when you invest in content that speaks directly to financial professionals and consumers alike, you set a foundation for lasting engagement.

Industry Trends Shaping Financial Content

With rapid advancements in technology and a shifting consumer mindset, the strategies behind financial content marketing are continuously evolving. One emerging trend is an increased focus on data security and customer personalization. As data breaches and privacy concerns become more prominent, financial institutions must emphasize transparent data practices and tailor content to individual customer needs. This means using insights and analytics to create targeted content that speaks directly to specific user segments, thereby enhancing engagement and trust.

Another notable trend is the rise of innovative digital storytelling techniques. From interactive infographics to immersive video explainers, modern content formats are being designed to simplify complex financial topics while keeping audiences engaged. Forward-thinking agencies are leveraging these multi-format strategies to extend the reach of a single piece of content across various platforms. By doing so, they not only reinforce key messages but also cater to the diverse ways in which today’s consumers prefer to receive information. Embracing these trends allows financial brands to stay ahead of the curve and continue to build authoritative content that resonates in a digital-first world.

9. Key Considerations and Common Pitfalls to Avoid

While the previous sections have highlighted the core attributes of a great financial content marketing agency, it’s also crucial to account for additional factors and recognize common pitfalls during the evaluation process. Delving into these extra considerations can provide a more rounded perspective and help safeguard your investment in a partner that truly aligns with your long-term goals.

Essential Factors to Consider Beyond the Basics

Beyond conversions, proven case studies, and streamlined processes, take a closer look at pricing models, scalability, and long-term strategic alignment. This means asking yourself:

- Does the agency offer pricing that scales with your growth, or will hidden costs emerge as your needs evolve?

- Can their content strategies adapt to the shifting dynamics of the financial industry without compromising quality or compliance?

- Are their long-term strategic goals and methodologies aligned with your institution’s vision for growth?

Insights from resources like the Content Marketing Institute’s guide on choosing the right agency emphasize the importance of these additional factors. Ensuring flexibility in pricing, a robust strategy for scaling content, and an ongoing alignment of values are all key to building a lasting partnership that can roll with market changes and support your institution as it evolves.

Common Mistakes When Choosing an Agency

Even with great potential partners in view, several common pitfalls can undermine the selection process. A frequent error is choosing a provider solely based on low pricing, which might result in compromised quality or insufficient industry-specific expertise. Other mistakes include:

- Overlooking the importance of thorough communication protocols, leading to delayed responses or misaligned expectations.

- Failing to investigate how the agency maintains regulatory compliance and adapts content to meet evolving guidelines, which is critical in the financial sector.

- Relying solely on headline metrics without delving into the detailed performance data that truly reflects how well campaigns drive conversions and client engagement.

By steering clear of these common missteps—such as ignoring the nuances of pricing and failing to account for scalability—you can better position your marketing efforts for long-term success. Striking a balance between cost and quality, while ensuring a deep understanding of your industry's needs, is the key to forging a productive and sustainable agency partnership.

Wrapping Up

Choosing the right financial content marketing agency is a strategic decision that requires a comprehensive evaluation of various factors. From assessing conversion-driven strategies and analyzing detailed case studies to ensuring robust content workflows and verifying industry-specific expertise, each of the seven tips we’ve discussed plays a critical role in guiding your decision.

By focusing on measurable conversions, reviewing proven track records, implementing efficient content creation and distribution processes, and prioritizing compliance and ethical standards, you position your financial brand for success. Equally important is the ability to repurpose content effectively, distribute it across multiple channels, and maintain clear communication with your agency. These elements together not only help in optimizing your marketing spend but also build trust and credibility in a highly regulated landscape.

Ultimately, aligning your strategic goals with an agency that understands the nuances of the financial sector is essential. If you’re looking to streamline your content marketing efforts and gain a competitive edge, consider exploring solutions that automate and enhance your marketing process. Learn more about how innovative approaches can take your strategy to the next level by visiting RankYak.

Take the next step towards smarter financial content marketing, and ensure every piece of content is driving meaningful results for your business.

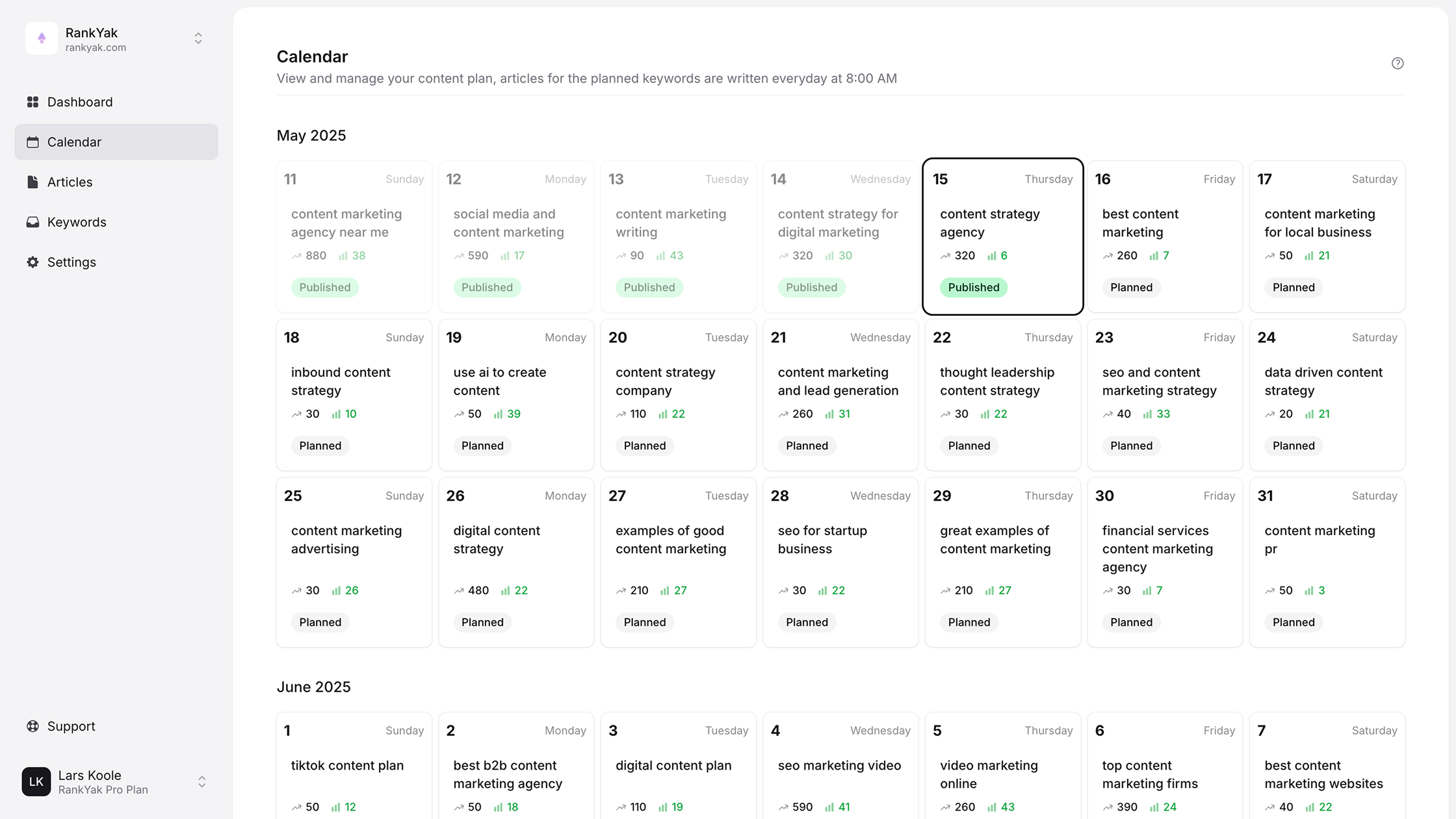

Get Google and ChatGPT traffic on autopilot.

Start today and generate your first article within 15 minutes.